Back to business as usual, or is it?

Finally no more working from home. Finally no more explaining to the children that even though Mum and Dad are at home they have to work all day. Finally a proper office chair and discussions with colleagues; still with physical distancing, sure, but in person instead of via video or audio conference call. Even the various market indices are rapidly nearing a level last seen prior to the coronavirus crisis. We have almost returned to the status quo. So, all’s well again, isn’t it?

Not quite. Things have changed compared to three months ago. Not only do social distancing rules apply in the office now, but quite a bit seems to have fundamentally shifted in the investment landscape as well. Despite – or perhaps because of – the meteoric market recovery, we too are faced with the following questions:

- Is the recession over already, or are the markets completely disconnected from economic reality due to the various stimulus packages?

- Have recessionary insolvency problems suddenly gone away, or have they merely been pushed back?

- What problems will emerge in future from the flood of liquidity created by central banks that is currently having such a calming effect on the markets?

This last question in particular strikes us as the starting point for many of the incongruences raised in the previous questions. For that reason, we will now take a critical look at the role of central banks.

For hundreds of years, banks were generally the primary lender for businesses. The bond market as it exists today was not possible until the practice of securitising such debt became more common. Now, corporate bonds account for more than half of outstanding corporate debt. Put simply, the role of central banks is now to set the price of the money through short-term interest rates. Of course, this has a direct effect on the demand for money and thus also on the bond market, which puts a price on default risk by means of the respective credit spreads. This consequently means that, through the well-known mechanism of supply and demand, each company’s bond issue can be priced individually according to its creditworthiness. So the theory goes.

However, current practice turns this on its head to some extent. Not only have the now record-low central bank interest rates over time led to sharp price rises in many asset classes, but also direct market intervention by central banks – lately in the form of purchase programmes for corporate bonds – has reached a whole new level. This policy, which has been European Central Bank practice for a number of years, has now been embraced by the U.S. Federal Reserve as well. The Fed has even begun to take non-investment grade bonds onto its balance sheet. In the process, the pricing of the default risk of companies is effectively being subverted by a price-insensitive buyer. The current magnitude of these purchase programmes seems relatively small compared to the total size of the market. However, the mere declaration of intention of such powerful buyers, who can print the cash required if need be, is enough to have a lasting influence on the market. In this context, the principle known as Goodhart’s Law¹ has practical application for the use of targets. The law states: “When a measure becomes a target, it ceases to be a good measure”.

In the case at hand, the intervention by central banks is targeted at the measure of default risk, which thus cannot function well as a measure. It is not our intention to examine here whether the end – that is, avoiding a dysfunctional bond market in the short term, with all the consequences that entails – justifies the means. The point is rather to highlight what consequences arise when central banks are effectively prepared to assume market credit risk on a grand scale.

On the one hand, this results in companies with uneconomical business models – that is, companies that are neither growing nor making a profit – surviving, as they continue to receive external financing at terms they can afford now and in the future. An obvious result of this is that, at a macroeconomic level, a lot of capital gets misallocated. In addition, as there are a large number of value traps amongst the affected companies, the pre-existing outperformance of growth companies versus value companies only becomes further pronounced On the other hand, the lower interest rate and the underestimated credit risk tends to reward financial engineering rather than alternative and sustainable investment. The long-term consequences will be weaker economic growth and lower returns. The third consequence of these measures concerns capital investment in general, and moral hazard specifically. Again, active managers who, anticipating a severe recession and the associated higher rate of insolvency, deliberately reduced risks in their portfolios were not rewarded for this prudence. Instead, the investors who got the best returns were the ones who went all-in – to borrow a poker term – when the central bank programmes were announced. Knowing that the central banks would nationalise credit risk for a certain period of time created an incentive to buy that was completely out of step with companies’ economic reality, amounting to moral hazard par excellence.

Now, the question is, of course, how to deal with this going forward. Given the circumstances, even though the temptation is strong to jump on the central bank bandwagon and follow the crowd towards higher-yielding investments, we advise caution. We doubt that the perceived “infinite” liquidity will lead to lasting solvency. For that reason, it will be all the more important in the future to balance expected return – be it bonds or equities – with the risk of default.

So we’re happy to say that perhaps not all that much has changed after all.

¹ The principle was named after Charles Goodhart, adviser to the Bank of England and professor at the London School of Economics and Political Science.

Positioning of the Ethna Funds

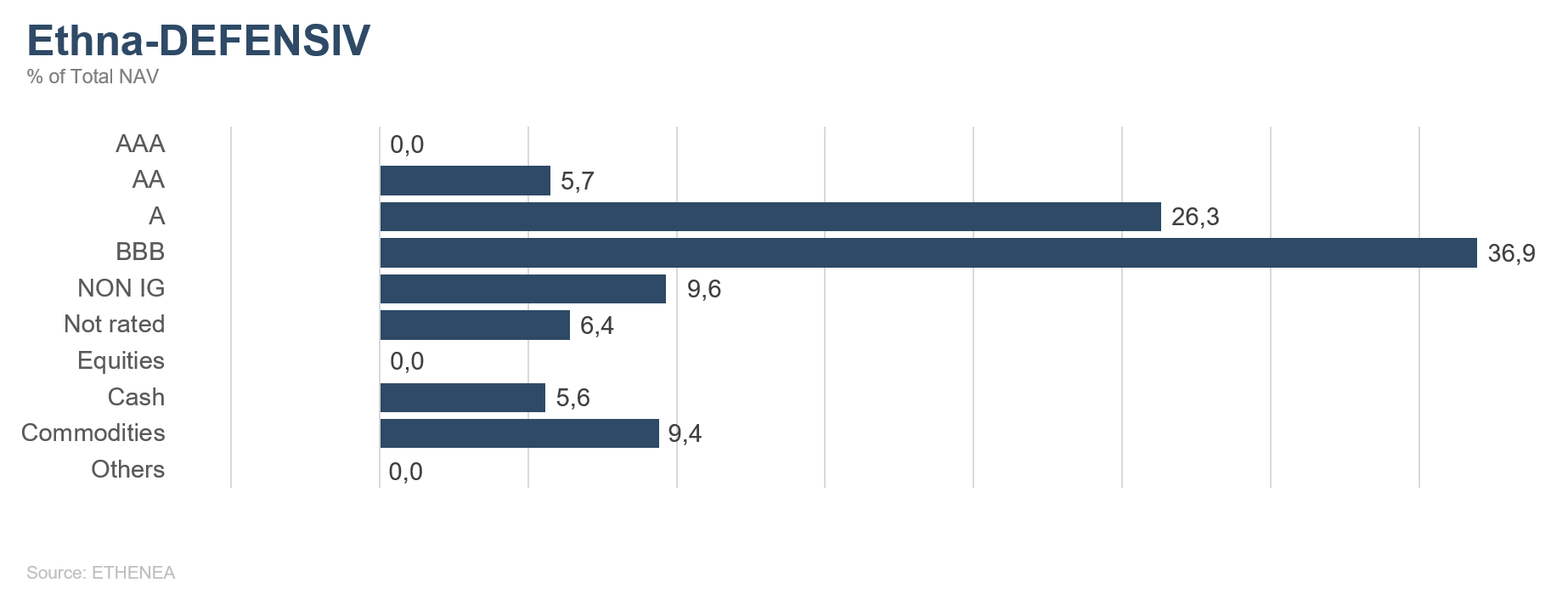

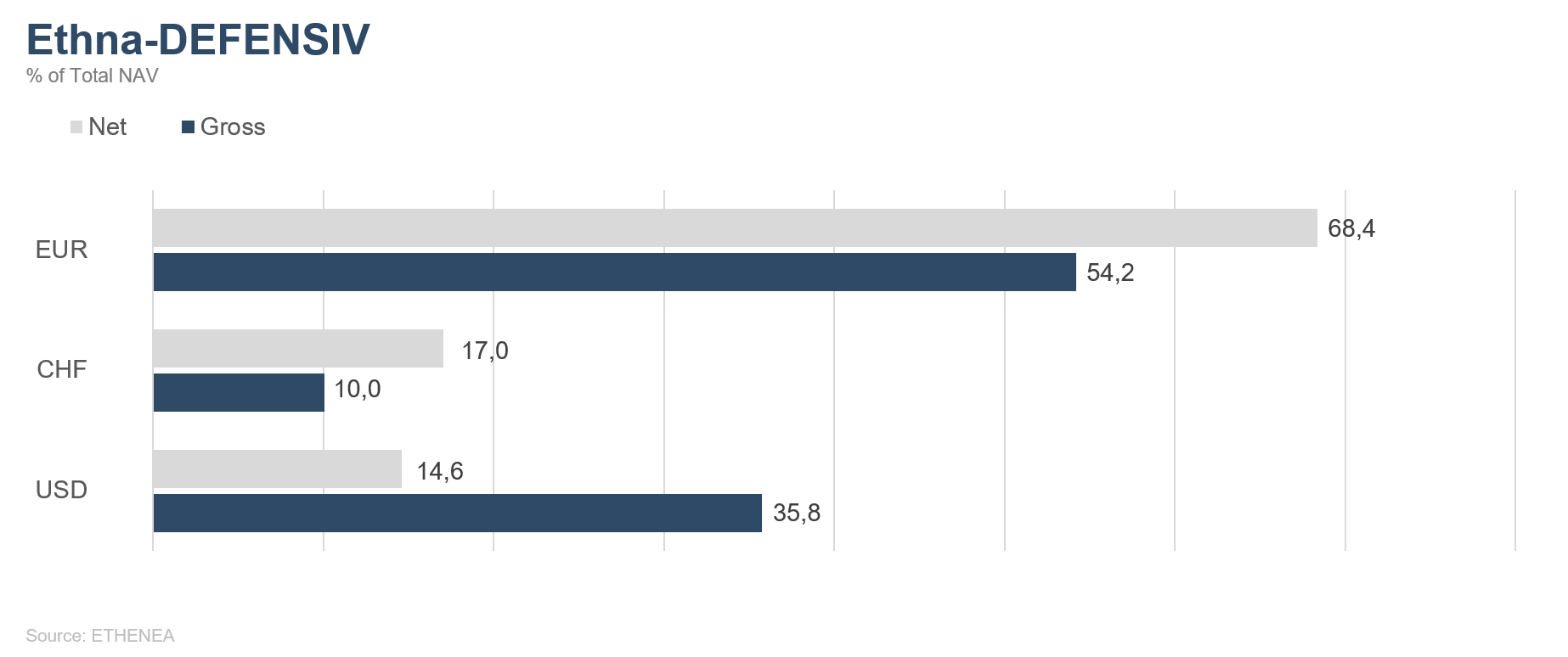

Ethna-DEFENSIV

Europe is seeing further easing of the COVID-19 restrictions that had been introduced, as the number of new cases is low despite local clusters of infection. Hopes for a rapid recovery in many areas of the economy are well founded. However, the impact on aviation and tourism will undoubtedly be felt for a while to come. The automotive industry is also still waiting for deliverance. For future demand, however, it is less the change in consumer behaviour (working from home, avoiding public transport and crowded shops) that is decisive, but rather the concern about falling customer purchasing power as well as the unanswered question about future-proof drive technology. Governments are trying to close these and other gaps in demand with their spending programmes. Meanwhile, talk of a EUR 750 billion economic recovery fund proposed by EU Commission President Ursula von der Leyen is continuing. The ECB’s purchase programmes are still under way, to the delight of the capital markets in particular. However, it took reassurance from the ECB to give the economic programmes any chance of success. The issue of international supply chain security has faded into the background. Even though the scene is set here for a rapid recovery, where fully functional capital markets and restored supply chains coupled with state economic programmes are reinvigorating the European economy, the latest economic forecasts look less rosy. In its recently published “Economic Outlook”, the OECD predicts that gross domestic product will be 9.1% lower in 2020 than in 2019 and forecasts a 6.5% recovery for 2021 for the eurozone. In light of this, the optimism we are seeing certainly is not based on reality, but rather on hopes for the future.

The number of cases in the U.S. is setting new records every day. Florida and Texas have become epicentres of the epidemic. Locally, easing measures that were in force are being rolled back. However, the lockdown in the U.S. had at no stage been as widespread or as extensive as in Europe. The fiscal and monetary assistance introduced by the Federal Reserve and the U.S. government are similar to that in Europe. Nevertheless, the OECD expects a somewhat lesser economic decline of 7.3% in the U.S., followed by a 4.1% recovery in 2021. However, these figures do not take into consideration the recent worsening of the pandemic in the U.S. Europe is by no means immune to a fresh outbreak of the virus either.

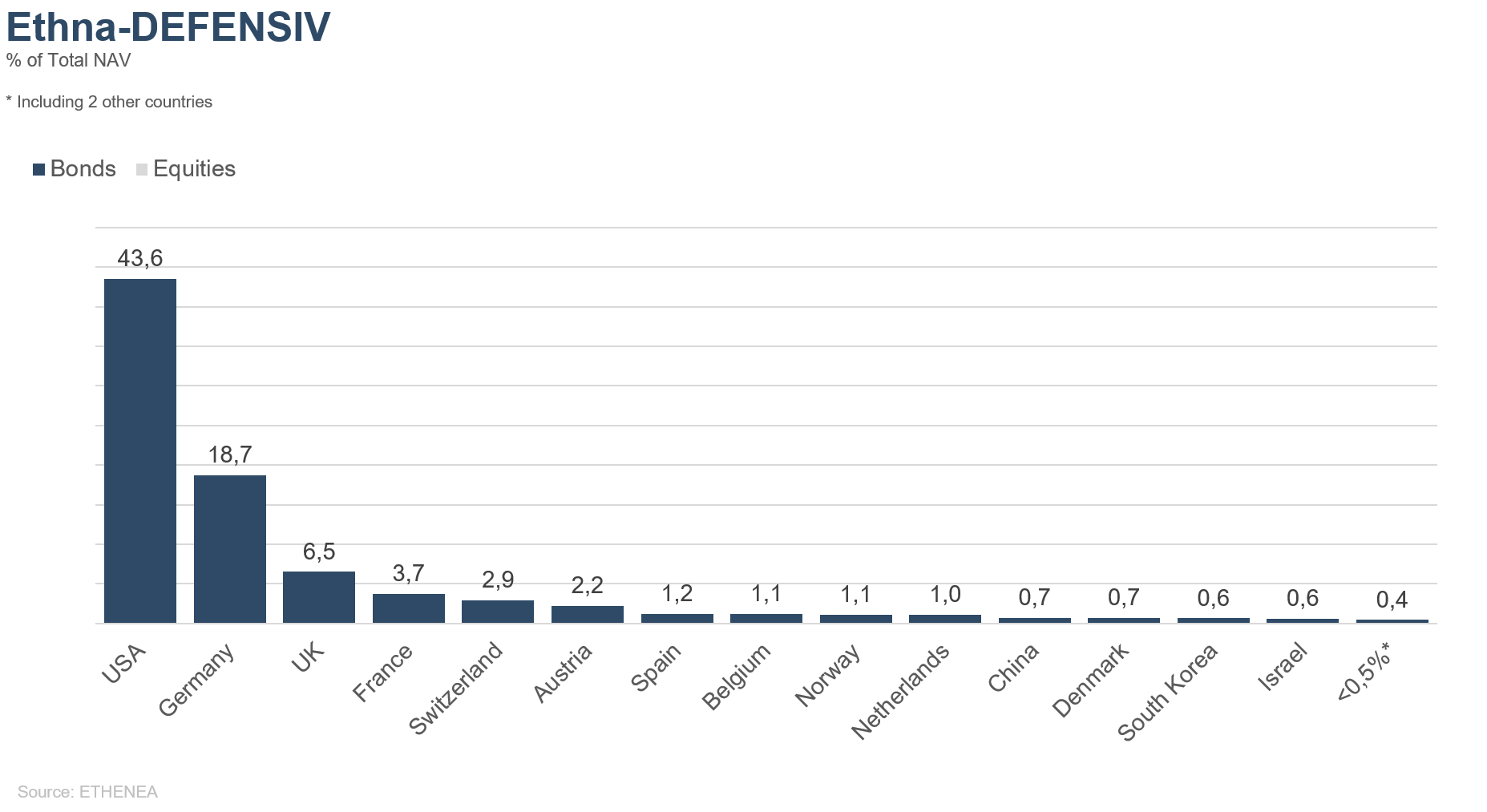

That being said, financial markets have been very stable over the month. Equity markets are approximately on a par with the previous month. There has also been little movement in the USD and CHF against the euro. On the other hand, the price of gold has risen further and corporate bonds have continued to recover (with little volatility) thanks to the direct support from central banks. Therefore, we made only slight changes in the Ethna-DEFENSIV. The existing liquidity was halved and stands at 5% following our investments in corporate bonds with attractive yields. The bond portfolio still consists equally of bonds denominated in EUR and USD However, we have reduced the open USD exposure to just under 15% through the use of FX forwards, since we believe the upward pressure on the USD has lessened. As we are expecting the CHF to continue to appreciate against the EUR, we have an allocation of almost 20% The unchanged gold allocation of just under 10% should benefit from further rises in the price of the precious metal.

In June, the Ethna-DEFENSIV (T class) gained further ground thanks to the advances made by its bond portfolio and its gold allocation, with a performance of +1.08%. YTD performance is only just inside negative territory, at -0.24%.

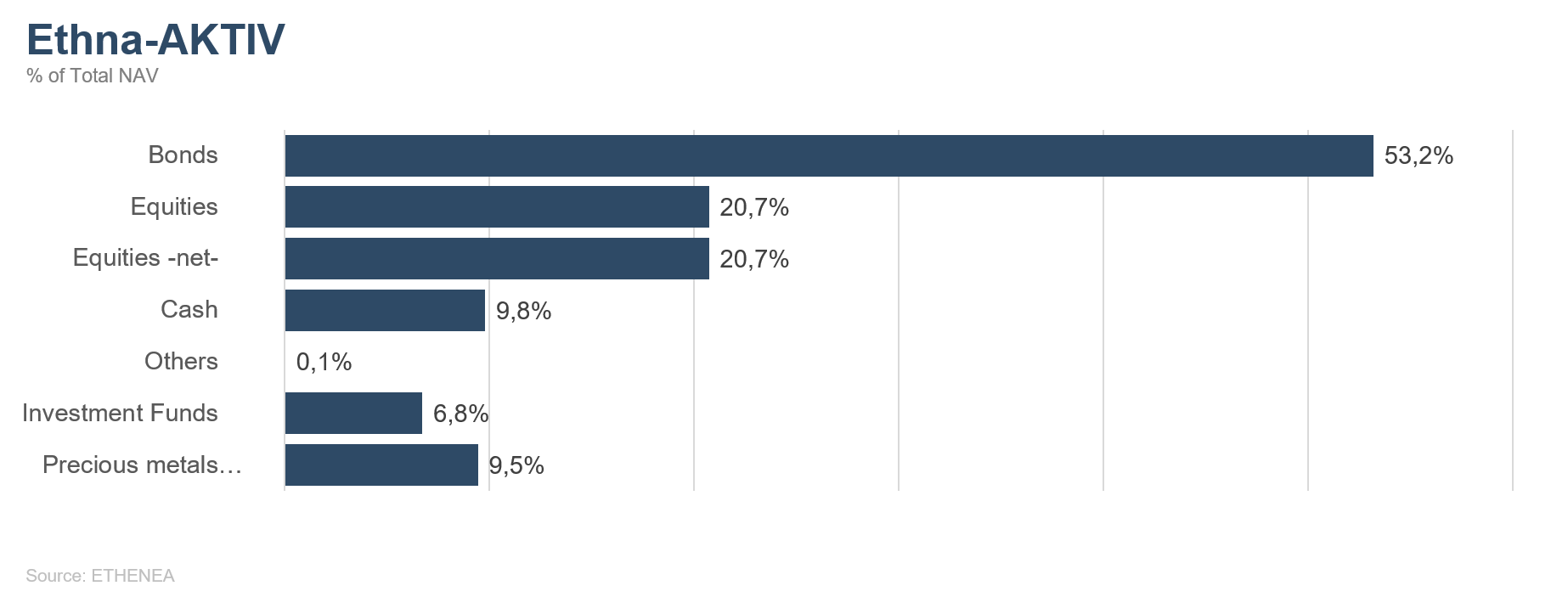

Ethna-AKTIV

Last month brought a close to the first half of 2020. Depending on your point of view, those six months either flew by or felt like an eternity.

In June, too, all the macrodata and market data revolved around the all-important question: how soon can the global recession caused by COVID-19 be overcome? Going by how bond and equity markets have performed recently, you could be forgiven for thinking there wasn’t an economic downturn at all. Highly diverse leading indicators and economic indicators were almost universally climbing. However, the distinction must be made here that the indicators, due to the rapid decline during the first quarter, are coming from a very low base, whereas some of the market indices are not far off their absolute all-time highs. From today’s perspective, we cannot definitively say whether this rapid recovery can be explained by forecasts of future corporate profits or whether it is solely down to the ultra-accommodative monetary policy. What we certainly can say is that in the last month the gap between economic realities (high unemployment, impending insolvencies and resulting low growth prospects) and stock market valuations has not gotten any smaller. We believe this is due to the ongoing poor sentiment and the resulting low level of investment among professional investors, as well as the support from central banks and the hopes for future state stimulus packages. The Federal Reserve recently announced that, in addition to the ongoing purchase programmes, which, like their European counterparts, now include bonds from almost the entire range of credit, it would keep interest rates low for a prolonged period (until 2022). In the words of Fed Chair Jerome Powell, “We are not even thinking about thinking about raising rates.”

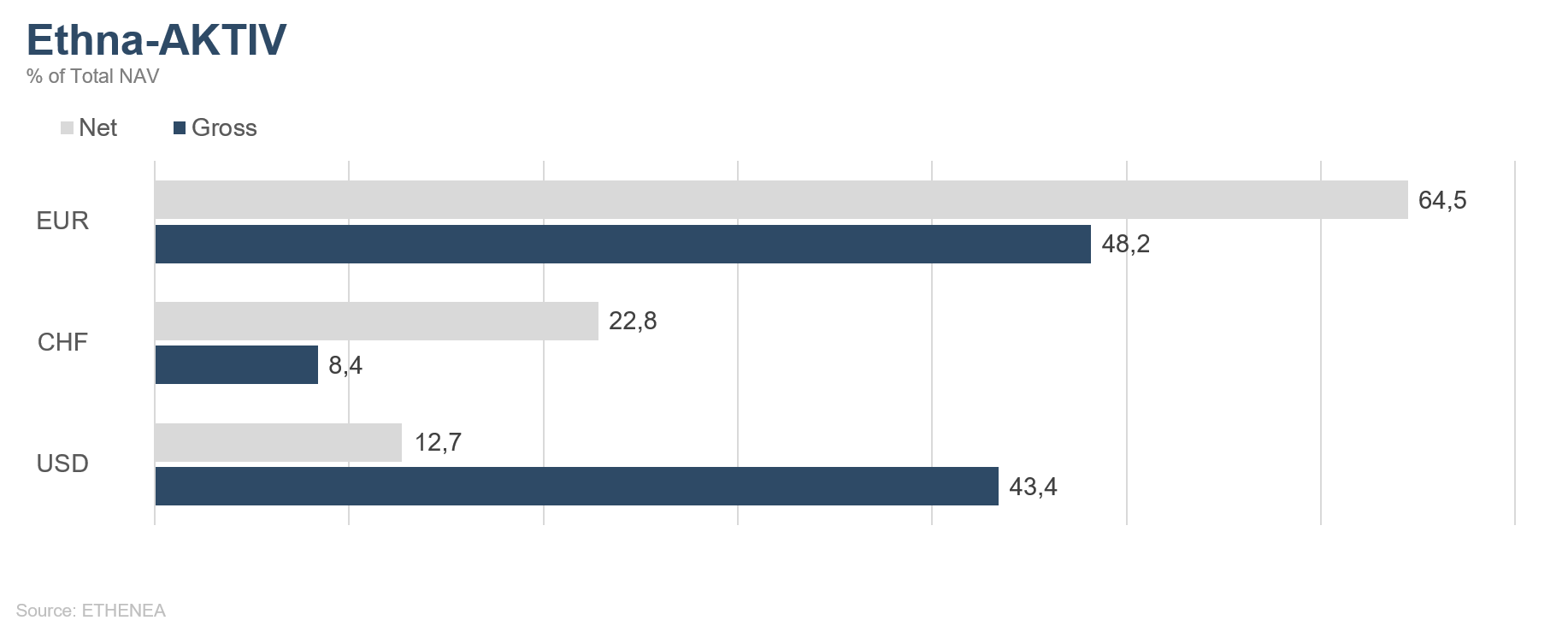

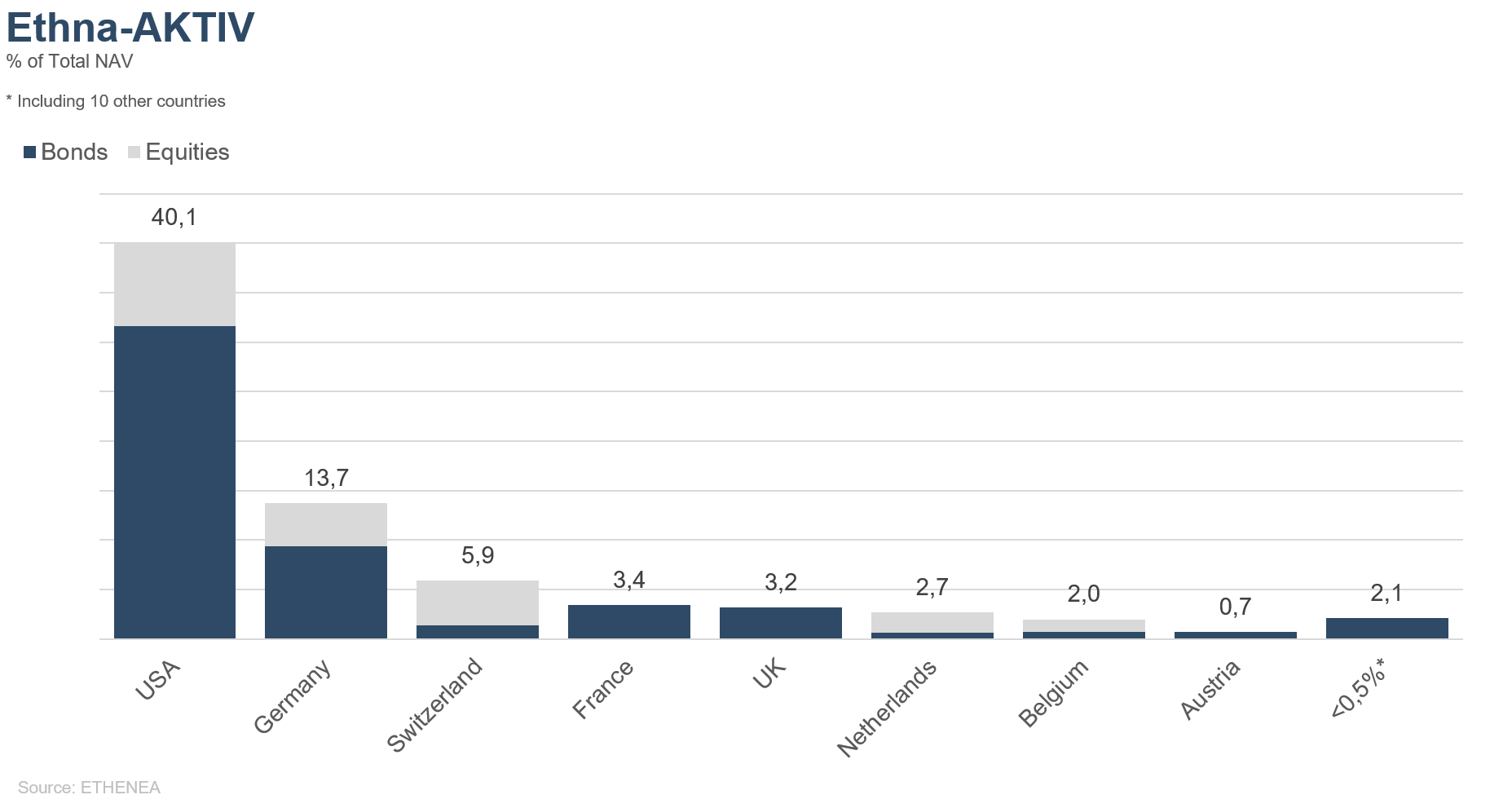

Against the backdrop of this almost entirely liquidity-driven environment, which is currently completely overshadowing other important aspects such as Brexit, the EU recovery fund, geopolitical tensions and the forthcoming U.S. presidential election, we are not prepared to increase the fund’s risk exposure significantly. Equity exposure in June varied to just over a defensive 20% and, with implied volatility still very high at over 30%, it will probably not be increased in the near future. The proportion of bonds was reduced by approximately 10%, bringing us very close to the target of 50% allocation. Given that risk premia have risen, we currently find selected corporate bonds outside the IG rating interesting. For that reason, again last month we took advantage of the record-breaking corporate issuance to increase the proportion of high-yield bonds in the portfolio (BBB- and lower) further, to approximately 7% at the moment. Gold, the price of which is now at an all-time high, remains at 9.5% in our portfolio – its maximum permitted weighting – due to ongoing positive expectations for the precious metal. We proceeded with our reduction in the USD allocation, which we initiated last month. The risk/reward ratio for the U.S. dollar at the moment does not recommend a high weighting in the fund. While the USD allocation was reduced to 13%, the CHF allocation remained unchanged at 22%.

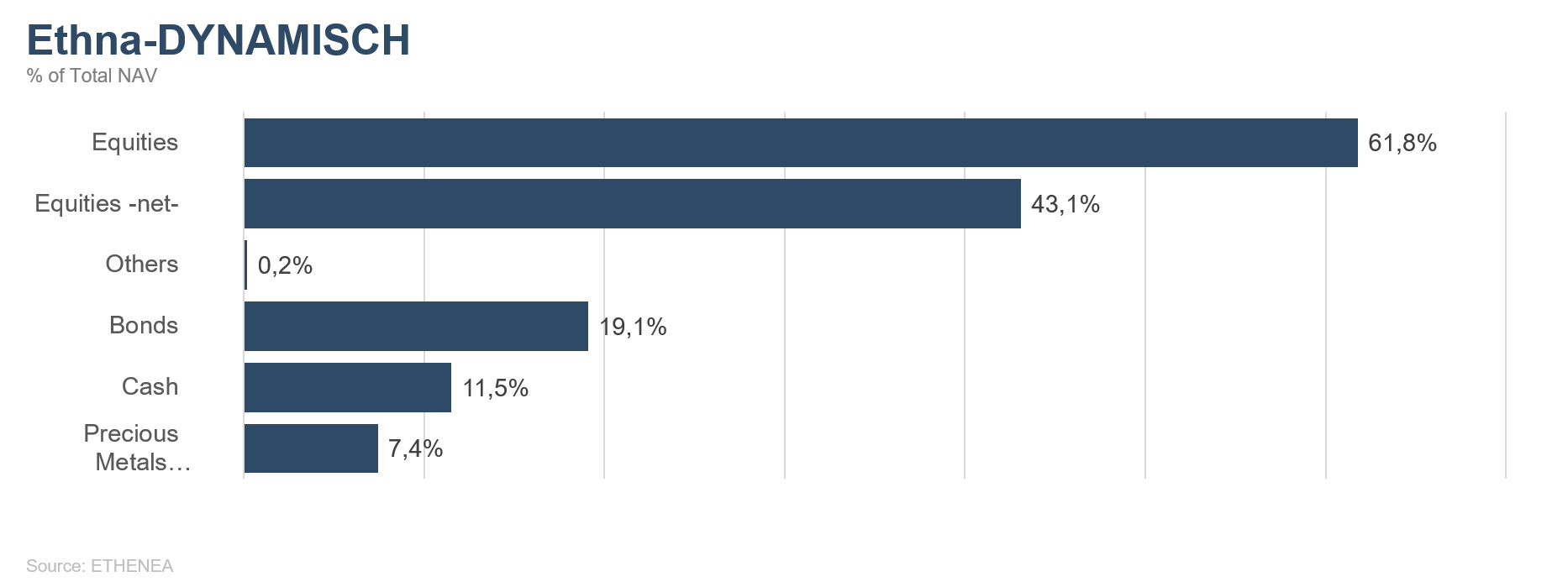

Ethna-DYNAMISCH

The daily task of an active portfolio manager, in a nutshell, is to balance opportunities and risk. It’s rare for them to be faced with a clear picture. Instead, what they have to do is take the multitude of influences on market development and weigh up the dynamics between the positive and negative factors to see to what extent the information is already reflected in the current prices in the capital markets.

Against this backdrop, prices in June were initially driven by the positive momentum of the preceding weeks. However, more and more investors were relying only on relative reasons to buy: arguments like “A has risen to a much greater extent than B, so B must hold potential to catch up” were often touted. In absolute terms, however, the risk/reward ratio was deteriorating. This is primarily due to the fact that, to an enormous extent, further positive performance is currently priced into valuations. At the same time, the economic downside risks resulting from the second- and third-round effects are continually growing. While the primary economic shock from the global lockdown was quickly and forcefully overcome by extensive fiscal and monetary measures, it is a mistake to assume that after such a shock job losses can be reversed, companies will resume investment to the usual extent and consumers will resume shopping with confidence within a matter of months or even quarters, in particular because the risk that coronavirus presents will be with us for some time to come. So, it is not all that surprising that the upward trend in share prices came to a halt after the first week of June.

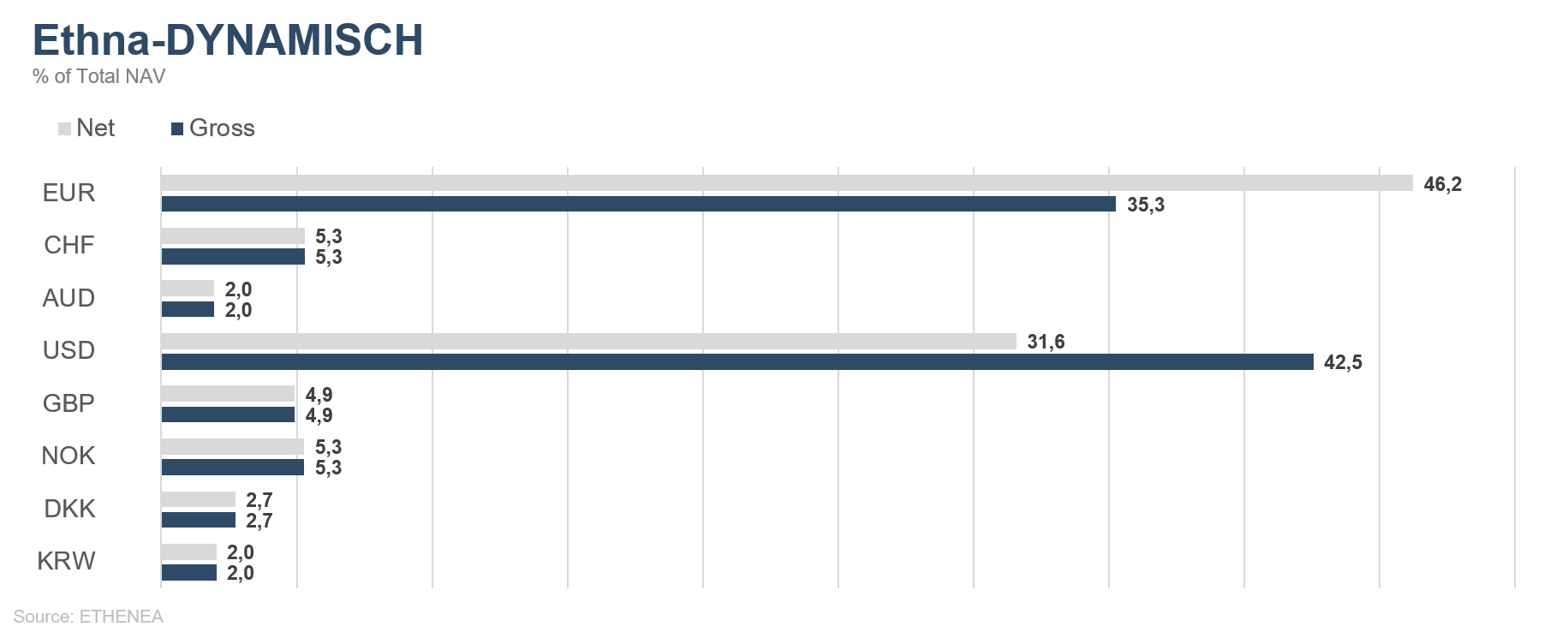

Within the Ethna-DYNAMISCH, we reduced risks with a countercyclical approach over the course of the month and successively prepared the overall portfolio for more turbulent times. For the first time since March, hedging was put in place again using put options on broad equity indices. In addition, existing hedging in equity index futures was increased, and – as indicated in the previous month – exposure to long-dated U.S. Treasuries and the gold allocation further expanded.

However, there was little turnover in the single stock portfolio. There was only one new addition to report towards the end of the month, when we built up an initial position in the German CompuGroup Medical (CGM) when it completed a substantial share placement. CGM is a leading provider of software in the healthcare sector, which connects doctors, pharmacists, payers, laboratories, rehab and care facilities as well as hospitals with one another. CGM has been established for thirty years. Founder and CEO Frank Gotthardt still owns one third of the company, which was last valued at around EUR 3.5 billion. The company currently operates in more than 50 countries around the world. Thanks to a healthy balance sheet and good products, CGM is ideally placed to participate in the further growth of its target markets.

Figure 1: Portfolio structure* of the Ethna-DEFENSIV

Figure 2: Portfolio structure* of the Ethna-AKTIV

Figure 3: Portfolio structure* of the Ethna-DYNAMISCH

Figure 4: Portfolio composition of the Ethna-DEFENSIV by currency

Figure 5: Portfolio composition of the Ethna-AKTIV by currency

Figure 6: Portfolio composition of the Ethna-DYNAMISCH by currency

Figure 7: Portfolio composition of the Ethna-DEFENSIV by country

Figure 8: Portfolio composition of the Ethna-AKTIV by country

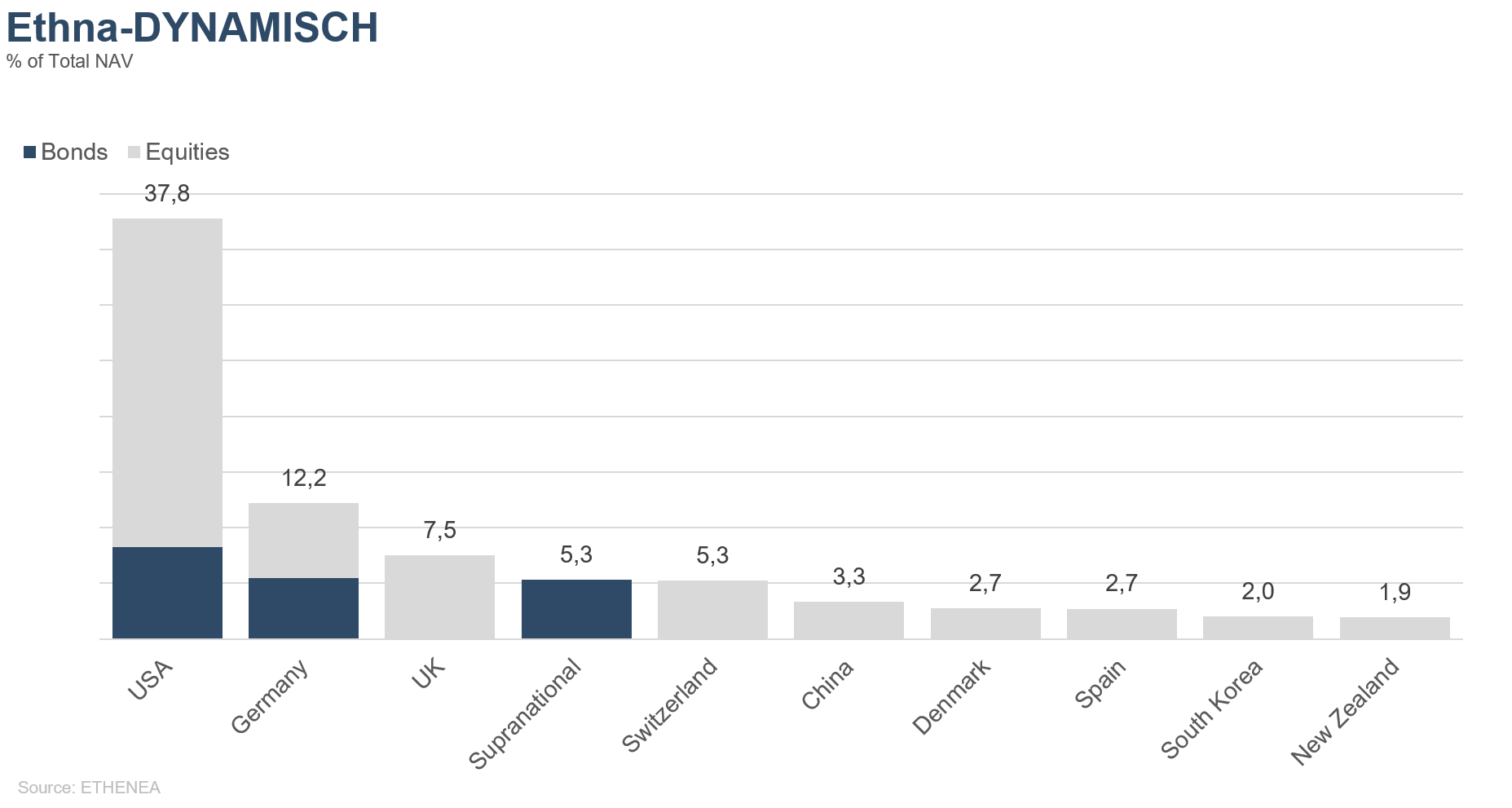

Figure 9: Portfolio composition of the Ethna-DYNAMISCH by country

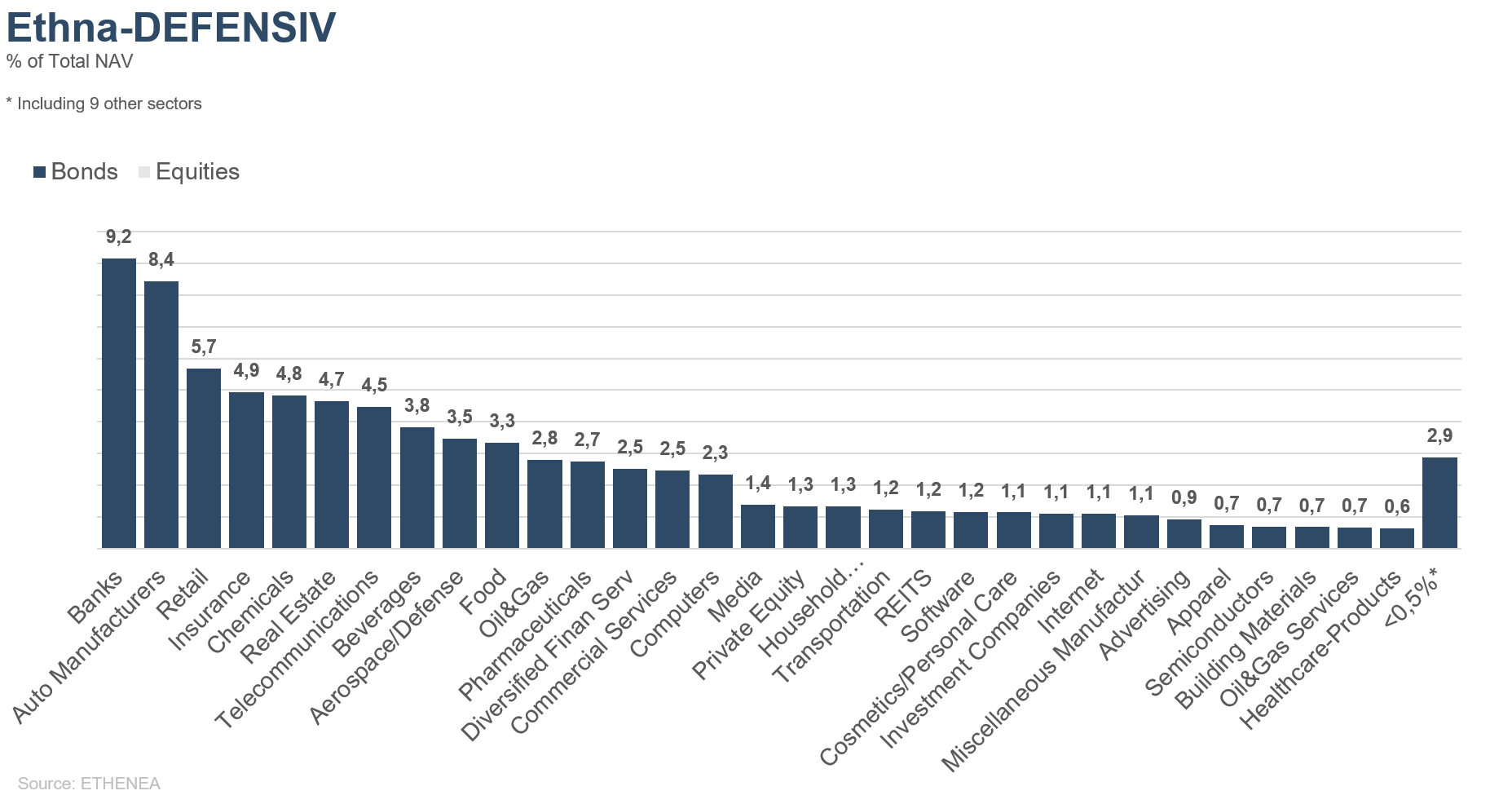

Figure 10: Portfolio composition of the Ethna-DEFENSIV by issuer sector

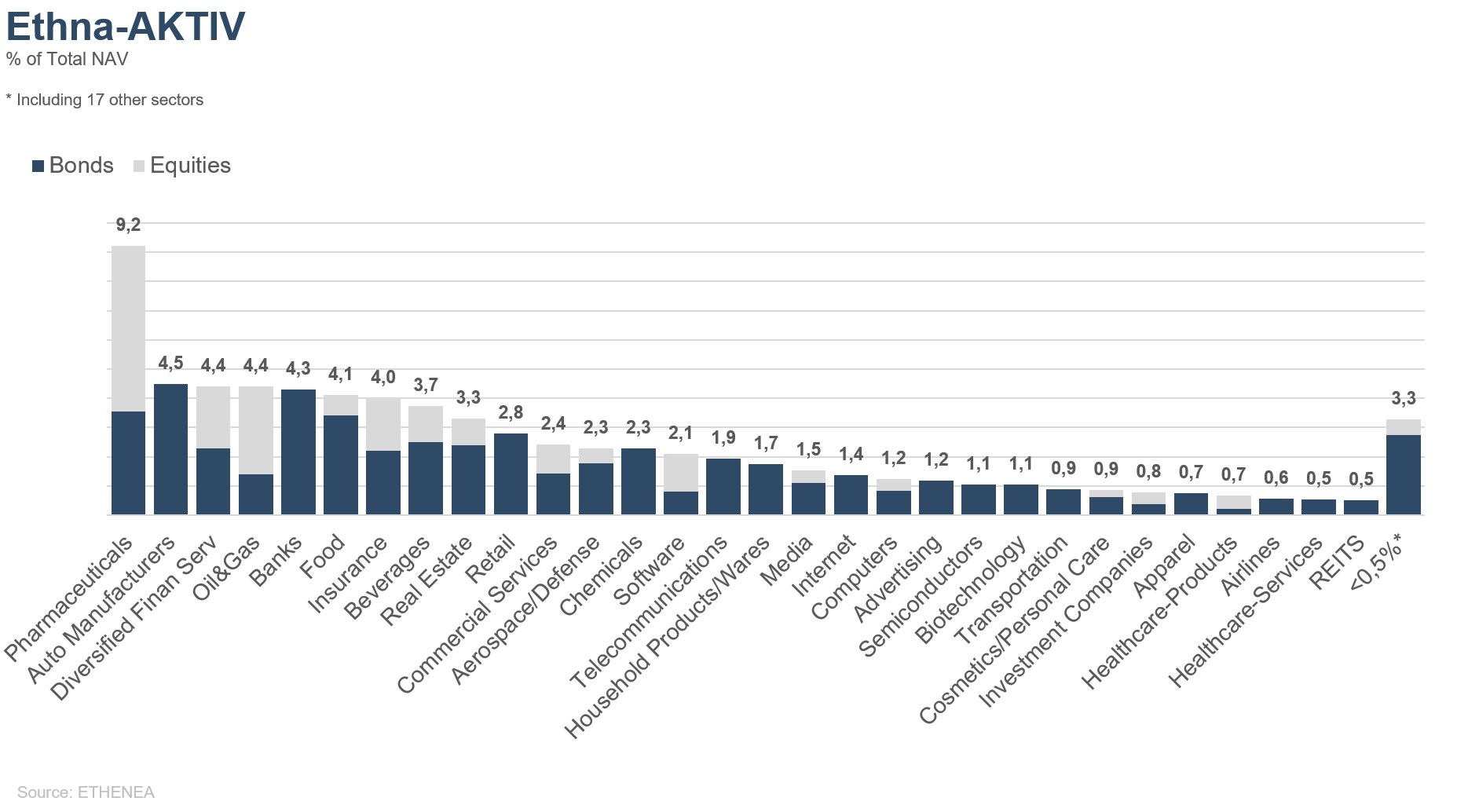

Figure 11: Portfolio composition of the Ethna-AKTIV by issuer sector

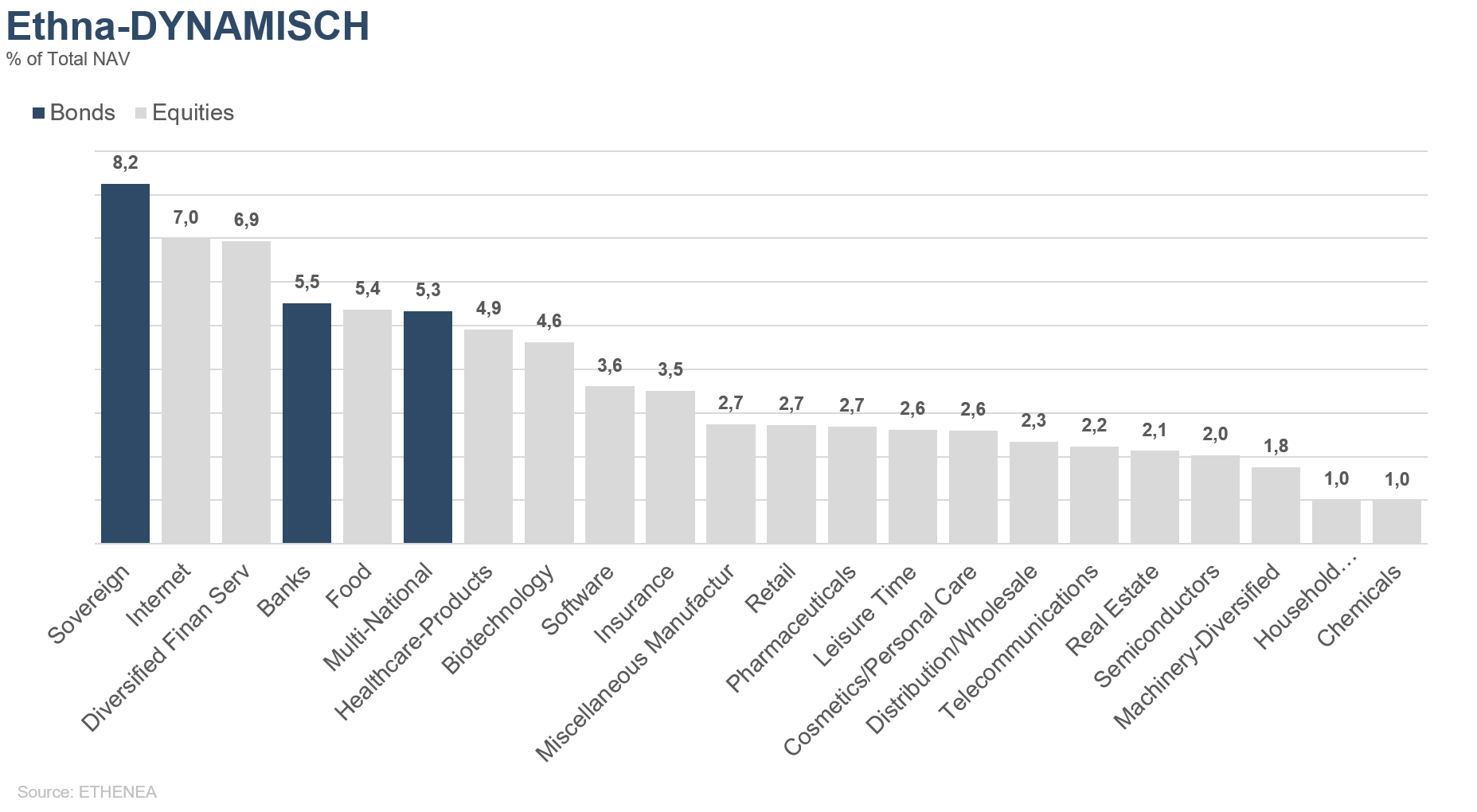

Figure 12: Portfolio composition of the Ethna-DYNAMISCH by issuer sector

* “Cash” comprises term deposits, call money and current accounts/other accounts. “Equities net” comprises direct investments and exposure resulting from equity derivatives.

Please contact us at any time if you have questions or suggestions.

ETHENEA Independent Investors S.A.

16, rue Gabriel Lippmann · 5365 Munsbach

Phone +352 276 921-0 · Fax +352 276 921-1099

info@ethenea.com · ethenea.com

Deze marketingmededeling dient uitsluitend ter informatie. Het mag niet worden doorgegeven aan personen in landen waar het fonds niet voor distributie is toegestaan, met name in de VS of aan Amerikaanse personen. De informatie vormt noch een aanbod noch een uitnodiging tot koop of verkoop van effecten of financiële instrumenten en vervangt geen op de belegger of het product toegesneden advies. Er wordt geen rekening gehouden met de individuele beleggingsdoelstellingen, financiële situatie of bijzondere behoeften van de ontvanger. Lees vóór een beleggingsbeslissing zorgvuldig de geldende verkoopdocumenten (prospectus, essentiële informatiedocumenten/PRIIPs-KIDs, halfjaar- en jaarverslagen). Deze documenten zijn beschikbaar in het Duits en als niet-officiële vertaling bij ETHENEA Independent Investors S.A., de bewaarbank, de nationale betaal- of informatiekantoren en op www.ethenea.com. De belangrijkste vaktermen vindt u in de lexicon op www.ethenea.com/lexicon/. Uitgebreide informatie over kansen en risico's van onze producten vindt u in het actuele prospectus. In het verleden behaalde resultaten bieden geen betrouwbare indicatie voor toekomstige prestaties. Prijzen, waarden en opbrengsten kunnen stijgen of dalen en kunnen leiden tot volledig verlies van het geïnvesteerde kapitaal. Beleggingen in vreemde valuta zijn onderhevig aan extra valutarisico's. Aan de verstrekte informatie kunnen geen bindende toezeggingen of garanties voor toekomstige resultaten worden ontleend. Aannames en inhoud kunnen zonder voorafgaande kennisgeving worden gewijzigd. De samenstelling van de portefeuille kan op elk moment wijzigen. Dit document vormt geen volledige risico-informatie. De distributie van het product kan vergoedingen opleveren voor de beheermaatschappij, verbonden ondernemingen of distributiepartners. De informatie over vergoedingen en kosten in het actuele prospectus is doorslaggevend. Een lijst van nationale betaal- en informatiekantoren, een samenvatting van de beleggersrechten en informatie over de risico's van een foutieve netto-inventariswaarde-berekening vindt u op www.ethenea.com/juridische-opmerkingen/.In geval van een foutieve NIW-berekening wordt compensatie verleend volgens CSSF-circulaire 24/856; bij via financiële intermediairs aangeschafte participaties kan de compensatie beperkt zijn. Informatie voor beleggers in Zwitserland: Het land van herkomst van de collectieve belegging is Luxemburg. De vertegenwoordiger in Zwitserland is IPConcept (Schweiz) AG, Bellerivestrasse 36, CH-8008 Zürich. De betaalagent in Zwitserland is DZ PRIVATBANK (Schweiz) AG, Bellerivestrasse 36, CH-8008 Zürich. Prospectus, essentiële informatiedocumenten (PRIIPs-KIDs), statuten en de jaar- en halfjaarverslagen zijn gratis verkrijgbaar bij de vertegenwoordiger. Informatie voor beleggers in België: Het prospectus, de essentiële informatiedocumenten (PRIIPs-KIDs), de jaarverslagen en de halfjaarverslagen van het subfonds zijn op verzoek gratis in het Frans verkrijgbaar bij ETHENEA Independent Investors S.A., 16, rue Gabriel Lippmann, 5365 Munsbach, Luxemburg en bij de vertegenwoordiger: DZ PRIVATBANK S.A., 4, rue Thomas Edison, L-1445 Strassen, Luxemburg. Ondanks de grootst mogelijke zorg wordt geen garantie gegeven voor de juistheid, volledigheid of actualiteit van de informatie. Alleen de originele Duitstalige documenten zijn juridisch bindend; vertalingen dienen alleen ter informatie. Het gebruik van digitale advertentieformaten is op eigen risico; de beheermaatschappij aanvaardt geen aansprakelijkheid voor technische storingen of schendingen van gegevensbescherming door externe informatieaanbieders. Het gebruik is alleen toegestaan in landen waar dit wettelijk is toegestaan. Alle inhoud is auteursrechtelijk beschermd. Elke reproductie, verspreiding of publicatie, geheel of gedeeltelijk, is alleen toegestaan met voorafgaande schriftelijke toestemming van de beheermaatschappij. Copyright © ETHENEA Independent Investors S.A. (2025). Alle rechten voorbehouden. 03-07-2020